Crypto trading has taken the world by storm in the last several years, with Bitcoin’s (BTC) price making global news when it hit its highest-ever value of $19,783.21 on December 17, 2017. People around the world have taken notice and have begun to do their research on Bitcoin and other cryptocurrencies.

The cryptocurrency community has a large, global user base with varied areas of interest. Some folks are just crypto enthusiasts who are fascinated with the philosophy and technology behind crypto. They may hold Bitcoin or another type of cryptocurrency for long periods of time and perhaps spend it occasionally.

Some folks trade bitcoin and “altcoins” on exchanges, making money like they would trading stocks. Others are still captivated by blockchain technology and may “mine” cryptocurrencies.

What does all of this mean, and how are people using cryptocurrency and making money with it every day?

If you are someone asking what cryptocurrency and crypto trading is and looking for general information on what goes into this digital money, then read on!

Table of contents [Show]

A Brief History of Crypto

Cryptocurrencies have been around since 2009, when the original crypto, Bitcoin, first arrived on the scene. Bitcoin was created by the pseudonymous developer (or group of developers), Satoshi Nakamoto. The domain name “bitcoin.org” was first registered in August 2008, and Nakamoto’s famous whitepaper Bitcoin: A Peer-to-Peer Electronic Cash System was released shortly thereafter in October.

In January 2009, Satoshi Nakamoto released the Bitcoin software as open-source code. This means anyone can read and verify the code and contribute their own code if they wish. Open-source code allows other developers to build their own projects on top of Bitcoin.

January 3, 2009, saw the first mining of the Bitcoin blockchain, otherwise known as “the genesis block,” by Satoshi Nakamoto. The Bitcoin developer continued to mine bitcoins and contribute to the project until 2010 when he handed over the network keys and control over code repositories to developer Gavin Andresen.

Satoshi mined over a million coins before disappearing in 2011, and none of those coins have moved from the original wallet since. To this day, the person (or persons) known as Satoshi remain anonymous – a mystery that’s yet to be solved.

The first-ever commercial transaction involving bitcoins occurred in 2010 when Laszlo Hanyecz bought two pizzas from Papa John’s for 10,000 BTC. Back then, the value of one bitcoin was lower than a penny. The price continued to make its way slowly up, with one bitcoin being worth around fifty cents at the end of 2010.

Since then, bitcoin has exploded in value, with one coin now being worth anywhere from a few thousand to tens of thousands of dollars.

In 2019, the Bitcoin price remained somewhat stable, fluctuating in value between $10,000 and $13,000. There are thousands of “altcoins” on exchanges as well, with some of the more popular and valuable alts being Ethereum, Litecoin, Monero, and Dash.

What is the Blockchain and Blockchain Technology?

To answer the question of what crypto trading is, we must also answer what the blockchain is. The two go hand in hand, as Bitcoin and other cryptocurrencies could not exist without what is known as the blockchain, or blockchain technology.

Blockchains are, essentially, lists of records called blocks that are verified and linked using cryptography. Every block contains information such as transaction data, a timestamp including the exact time and date of a transaction, and a cryptographic hash of the preceding block.

The blockchain is an immutable public ledger. It records every transaction in the history of a specific coin and can be viewed anywhere by any member of the public. Data can’t be altered on one block without altering all subsequent blocks.

The decentralized aspect of the blockchain is what makes it trusted and virtually immune to attacks or takedowns.

Because anyone can act as a blockchain node (using a dedicated machine to connect to the network, download, and sync the whole blockchain), no centralized entity acts as the blockchain's controlling force. Anyone is free to run the open-source Core software and download and sync the blockchain.

With so many machines and nodes on the blockchain run by individuals and professionals all over the world, there is no single point of failure, making the blockchain incredibly secure and incorruptible. No one party controls the blockchain, and because it is so open, everyone is free to participate and make it even more secure.

Blockchain technology has been proven to be great for several uses. Some of these include:

- Cryptocurrencies: The first reason for the blockchain's existence is that the blockchain tech behind cryptocurrencies records and validates every transaction on the network. New units of the currency are mined when pools solve blocks, and every miner in the pool gets a share of the reward.

- Smart contracts: Made popular with Ethereum, smart contracts are proposed contracts that can be completed without any human interaction. Using automated escrow, once a smart contract is funded, parties can rest assured that they are not going to get ripped out of money after the completion of the terms of the contract.

- Video games! Blockchain tech has even found its way into video games, with a game called “CryptoKitties” taking the world by storm in 2017. Virtual pets were created, traded, and sold around the world. One sale on the CryptoKitties platform was when a virtual cat sold for around $100,000!

- Blockchain tech is being used in financial services, healthcare sectors, and entertainment industries and is even proposed for voting systems. Being public, transparent, and immutable ledgers, blockchains are a great way for almost any type of industry to utilize peer-to-peer technology.

What Are Altcoins?

Anyone wondering what crypto is will surely see the word “altcoins” in their research on crypto trading. There are thousands of cryptocurrencies on the market, each one created by different sets of developers for entirely different purposes. Some people really get into the different projects going on and learn all about their history, purpose, and development teams. Others (like traders) see altcoins as penny stocks that they can buy low and sell higher for a quick profit.

Any coin that is not Bitcoin is considered an altcoin. All altcoins’ values are based on the current value of Bitcoin. Many altcoins exist, with new ones coming out every year and still others falling by the wayside as another failed project. Some of the most popular and long-standing altcoins are:

- Litecoin: The original altcoin, dubbed “the silver to Bitcoin’s gold,” Litecoin was created by former Google engineer and MIT alumni Charlie Lee in 2011. Litecoin uses the script mining algorithm instead of Bitcoin’s SHA-256, and it is well known for having quicker block-generation rates and faster transaction confirmation times.

- Ethereum: Launched in 2015, Ethereum was created for the facilitation of smart contracts and Distributed Applications (otherwise known as D’Apps). The ether blockchain encourages developers to build applications on top of it, and it can be used for almost anything. The ether blockchain was used for the wildly popular 2017 CryptoKitties game. In 2016, Ethereum was split into two new chains, which spawned a new coin called Ethereum Classic.

- Dash: Dash was launched in 2014 and is a more private bitcoin. Otherwise known as darkcoin, it runs on a decentralized master code network that helps make transactions virtually untraceable, offering users much more anonymity. Dash was made and developed by Evan Duffield, and Dash stands for digital cash.

- Monero: Another coin loved for its privacy features, Monero is secure and untraceable. It was launched in 2014 and gained a huge following among privacy advocates, cryptography enthusiasts, and more. Donations from the community completely funded the development of Monero. With decentralization and scalability being the number one goal for this coin, it enables a special technique called “ring signatures” to ensure anonymity in transactions.

- Bitcoin Cash: One of the original forks, Bitcoin Cash spawned a new blockchain when it split off from Bitcoin in 2017. Due to arguments between developers and miners in the Bitcoin space, largely because of the integration of the SegWit (Segregated Witness) protocol that was known to impact block space, many developers of Bitcoin split off and created a new coin and chain. They called this new fork Bitcoin Cash, upping block sizes to 8MB to ensure faster transaction times and removing the SegWit protocol.

- Dogecoin: Dogecoin was created as a joke coin, taking its image from the popular Doge memes featuring the Shiba Inu dog in 2013. However, it gained a fervent following online and reached a market cap of $60 million in 2014. Created by Portland developer Billy Markus, Dogecoin has been used as a way to tip online content creators. The Dogecoin community also used the altcoin to raise money for DOGE4WATER, a campaign to dig a well in the Tana river basin in Kenya to help remediate the severe lack of potable water in the area. The community also raised $50,000 in Dogecoin to help the Jamaican Bobsled Team go to the Sochi Winter Olympics.

These are just a few examples of altcoins on the market right now, and there are literally thousands more to learn about if you want to get into buying them, holding them, or trading them. Other popular altcoins are Ripple, Cardano, Zcash, and Electroneum. All of these altcoins have a unique use case, great development teams behind them, and special reasons for their existence.

Some altcoins may not be worth much at all and may not ever be worth anything, but a good deal of them serve special functions and could be used to create something huge in the future.

The Scoop on Mining

Bitcoin and other cryptocurrencies couldn’t exist without the process behind creating them, known as mining. At its core, the mining process is the keeping of records done through the processing power of dedicated hardware.

Miners ensure the blockchain is complete, not altered, and consistent, verifying new transactions constantly and then broadcasting them to the network.

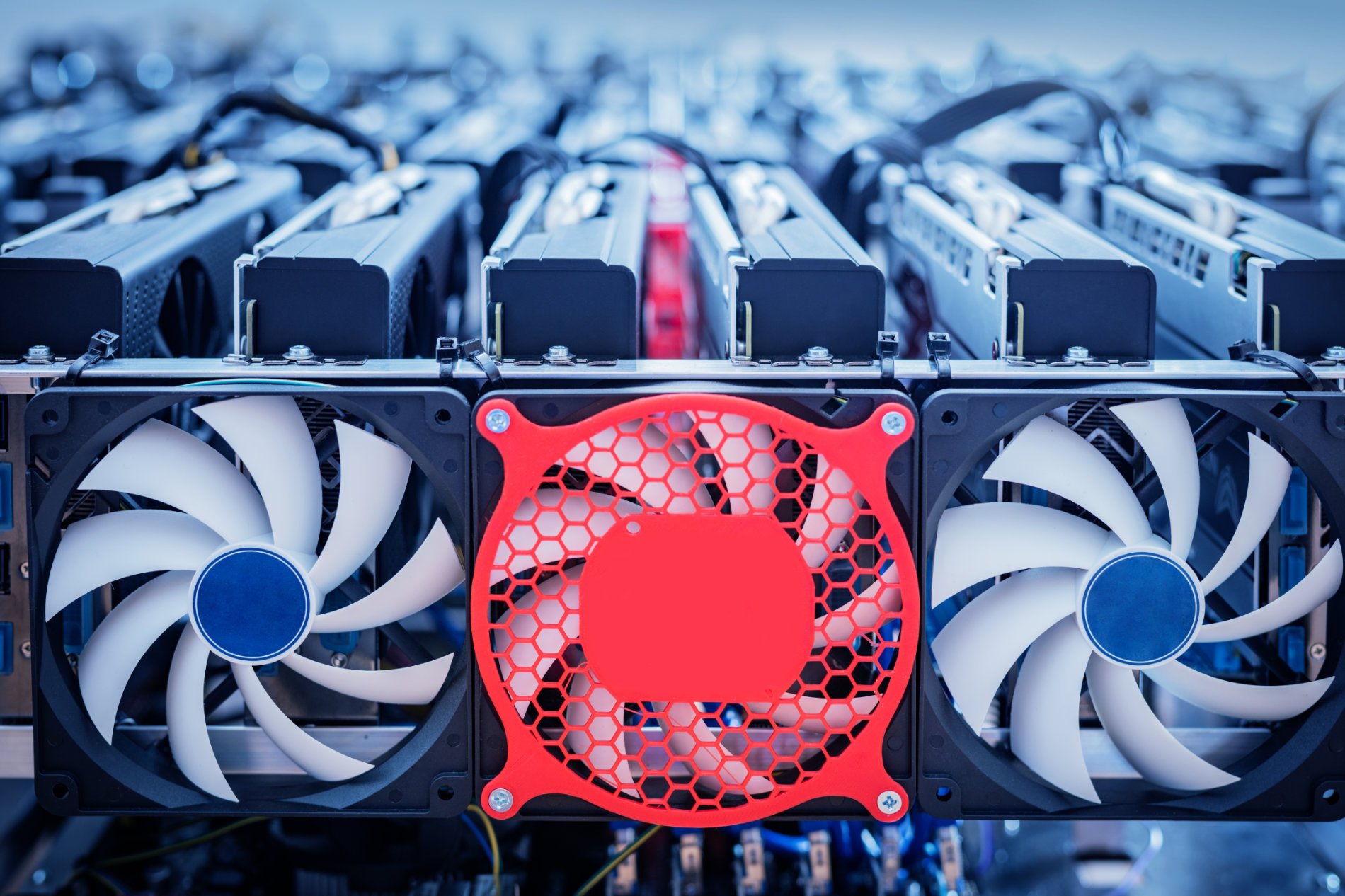

Bitcoin and other altcoin miners are, essentially, just dedicated pieces of hardware that use their collective processing power (also referred to as the hash rate) to solve mathematical equations at lightning speed and solve blocks repeatedly. These blocks verify all transactions that occur on their respective crypto’s blockchain, keeping the blockchain open, immutable, and public.

Back in the early days of Bitcoin, anyone interested could get into mining by using the processing power of their desktop computer. This was when it was easiest to get into Bitcoin mining, as the mining difficulty had increased so much that Bitcoin CPU mining was no longer profitable. Nowadays, individual miners and mining farms employ ASIC computers to profitably mine bitcoins. ASIC (application-specific integrated circuit) machines are built with one task in mind: mining.

ASIC machines are created by a variety of companies, some of the more popular ones being Bitmain’s Antminer collection. These machines are specific to a hashing algorithm and are, therefore, only able to mine certain coins. For example, Bitcoin can only be mined through the SHA-256 algorithm, while Litecoin is mined using a script algorithm.

Altcoins like Monero, Electroneum, Ethereum, and Dogecoin are still able to be mined with more traditional, cheaper hardware. Some of these coins’ developers proudly dub them ASIC-resistant, meaning that the developers want to keep them to where almost anyone can mine them. Coins that are ASIC resistant can be mined from any machine using its CPU, or, for additional hashing power, miners could employ graphics cards (known as GPU mining).

To begin mining with any machine, all a person has to do is decide what coin they’d like to mine, figure out the algorithm for that coin, and download the appropriate software to their computer. This process can happen entirely in a terminal and can work on all desktop platforms, such as Linux, Windows, or Mac.

Once the software and the algorithm are set up, all that is left to be done is to connect the machine to the desired mining pool.

Mining pools enable miners all around the world to connect together to solve blocks. Nowadays, solo mining for any coin would not see much profitability, so mining pools were created for users to network their machines together and mine together. When a block is found and solved by a pool, block rewards (coins) are then awarded to every miner in the pool. There are mining pools for every mineable coin.

Exchanges and Crypto Trading

While people who are fascinated by the technology behind Bitcoin and other altcoins may want to run miners to create coins for themselves, others just want to make money. These folks see various cryptocurrencies as new-age stocks or commodities and make crypto trading on various online exchanges to make money.

There are several ways folks can make money through trading cryptocurrencies. Some crypto-traders spend time day trading, and others watch trends, learn about various coins, identify ones that may hold value someday, and do longer-term trading.

Day trading is when a crypto trader will hold certain coins for shorter terms. They will identify dips in the market (when the price of a coin is low) and buy-in. They will then wait anywhere from a few hours to a few days until the price rises and sell at a higher price.

Long-term holders will make crypto trading by trying to buy into a coin for a very low price and hold it for months or even years before the price rises to a desired sell position.

Several cryptocurrency exchanges exist for the purpose of trading cryptocurrencies. These exchanges include Binance, Poloniex, ShapeShift, CEX.IO, Bittrex, Coinbase, and more. Created for the sole purpose of facilitating the buying and trading of almost every coin imaginable, many people make money through crypto trading on exchanges.

A few words of advice to anyone considering getting into trading: Never invest more money than you can afford to lose because the crypto market is highly volatile and unpredictable.

Coins have risen and crashed overnight, and people have made riches while others have lost a good deal of money. Also, never leave large amounts of coins in an exchange. If the exchange is hacked or goes down, your money could go with it, so always make sure you store any coins you’re not trading in a wallet that only you control.

Crypto Wallets: Keeping Your Coins Safe

Anyone asking what cryptocurrency is should be sure they have proper information on the safe storage of their coins to ensure they are secured from hackers and other malicious actors.

There are many types of crypto wallets available with varying degrees of security. These include online wallets (also known as hot wallets), mobile wallets, and standalone software or hardware wallets (also known as cold storage). Let’s explore the advantages of each type of wallet.

Online wallets

These are wallets created for you when you store coins on any online medium, such as a website or crypto exchange. Referred to as hot wallets, the best way to use these is to only keep coins for trading in them.

Since these wallets can only be accessed through the online medium, they’re stored on. You have to be able to trust the platform because it can always be hacked or go down. If that happens, your coins will go with them.

Some of the popular online wallets include Coinbase, Blockchain, and Freewallet. Exchanges where users can hold various coins include Binance, Bittrex, and Poloniex.

If you plan to store any amount of coins in these online wallets, ensure you are using 2FA (two-factor authentication) and a strong password to secure your funds.

It is never a good idea to store large amounts of coins in these online wallets long term, as we have learned through several major hacks on exchanges. In 2018 alone, we saw several exchanges hacked, and the hackers absconded with millions of dollars worth of users’ coins. In September, the Zaif exchange was hacked for over 60 million dollars worth of coins, while the Coinrail exchange lost around 40 million to hackers.

Standalone software and hardware wallets

These are the best types of wallets, as the user is the only one who controls the coins. These wallets can be used offline and have a variety of security measures backing them up, making them inaccessible to anyone who doesn’t have what is called the wallet seed.

Software wallets

Available on every desktop platform, such as Linux, Windows, and Mac, these wallets enable the safe, offline storage of your coins. One of the most popular, oldest, and most secure examples is Electrum. A good standalone software wallet uses encryption of your private keys, requiring a password entry before any coins leave the wallet.

Secure software wallets also require what is known as the wallet seed. Seeds are created upon creating a new wallet and should only be known by the wallet holder. If you know the seed in your wallet (memorized or written on a piece of paper), you will be able to access your coins from anywhere simply by downloading the software again and entering your seed. This comes in handy if your computer crashes and you need access to your coins quickly.

Hardware wallets

This is the best, most secure cold storage option. Many companies have created trusted hardware wallets, such as the Trezor, Nano Ledger X, and the KeepKey. These devices can sync with your existing wallet (such as Electrum) and further protect your coins.

Hardware wallets help keep the keys to your coins safe from internet-connected devices. Anything connected to the internet is vulnerable, and this is where hardware wallets really shine. Coin holders who utilize hardware wallets must have them in their position to use those coins, as the hardware wallet protects the private keys. This makes hacking your coins by trying to compromise your private keys online impossible.

While someone with bad intentions could always steal a hardware wallet, it has its own protection mechanisms, too. Hardware wallets can be further secured with PIN codes known only to the actual owner of the device. This helps make sure that if the hardware wallet is stolen, it is still useless to thieves, as they would have to crack your PIN, on top of your private key, to do anything with your coins.

Mobile wallets

Highly convenient, many of them are very secure and available right on your mobile device, such as your Android smartphone or tablet or your Apple iPhone or iPad. Mobile wallets can make it easy for you to take your crypto with you everywhere you go, and good mobile wallets offer a lot of the same functionality and security as a desktop wallet.

Mobile wallets can be downloaded from Google’s Play Store (for Android) or Apple’s App Store (for iOS). Both have several secure wallet options for whatever coin you may choose to hold.

- Android options. Electrum, for example, is available on Android devices via the Google Play Store. The Electrum wallet application allows you to access your desktop Electrum wallet on your phone, requiring only your Electrum seed to have access to those same coins on the go! Electrum is probably the best option for Bitcoin and Dash, while Monero has an official wallet on Android called Monerujo.

- iOS options. Apple is a little more limited in crypto applications on their App Store, but great wallet options for iPhones and iPads still exist. A few secure wallet options on iOS that include seed generation and require seeds for wallet recovery are the BreadWallet app (for Bitcoin) and LoafWallet (for Litecoin).

What Are Some Benefits of Using Crypto?

Many people are drawn to the philosophy, or ideology, behind crypto trading, and many folks who are curious about what cryptocurrency is may not be aware of some of these ideals quite yet. The advantages to using crypto are many, and widespread adoption of crypto will help make these advantages even more obvious.

Own your money

With cryptocurrencies, you are, essentially, your own bank. Not only do you control the private keys to your money, but you are free to do with it what you wish. There are no restrictions on what you can use your money for when you own everything. You are free to send coins from anywhere in the world to anyone in the world, no questions asked. All you need is the receiver’s wallet address.

Fewer transaction fees than traditional methods

Fees associated with transactions are much lower with cryptocurrencies than with credit cards or other means of fiat transfers. When sending crypto from one party to another, a small mining fee is usually processed, but these fees are small and insignificant compared to bank fees for “regular” money transfers.

There is much less risk of fraud

Fraudsters love credit cards because they are able to issue chargebacks to reverse transactions after they have paid someone. This makes merchants lose money when bad actors reverse transactions. With crypto trading, payments cannot be reversed. Once the coins are sent, and in your wallet, the coins are yours. The only way someone could get them back is if you send them back by yourself.

Payments Are Instant

Using blockchain technology, crypto payments are instantaneous. What might take days or even weeks with traditional payments takes minutes or even seconds with crypto. There is no waiting for banks, no business hours to follow, or anything like that. With cryptocurrency payments, the sender enters the address of the receiver, the network broadcasts the payment, and the coins make their way to the receiver’s wallet. No middlemen, no banks, and no ridiculous wait times.

So many things depend on banks nowadays, and so many people are dependent on bank accounts. Some folks may not be able to open a bank account due to the amount of money they are required to open one. Others still may not be able to open a bank account because of outstanding debts. Some may not be able to afford those pesky account maintenance fees most banks have.

This is not the case with crypto trading. With crypto, you are your bank. Your money is truly yours. You are free to send it to anyone, anywhere, at any time. There are no middlemen, and there are no maintenance fees on your crypto wallets. All you need to access your money is your unique wallet key. That’s all!

Looking Forward

The future of crypto trading looks bright, with so many more projects coming out every year. Many people are making innovations in the blockchain space. More and more people are asking the same question: what is cryptocurrency? Finding answers to that question will help them control their own finances and escape from the middlemen in banks who control everything from transaction times to where folks can send their money.

Cryptocurrencies offer us something new, something different. Not only do they offer us the chance to control our money completely, but they also offer privacy, complete transparency through the blockchain, and a trustless system.

The future of crypto will include wider adoption rates by more people around the world. As more people get educated on blockchain technology and how it can help us build more innovative products, more industries will adopt the tech. Industries such as finance and artificial intelligence are already looking at blockchain technology to build their products on top of.

There are big things in the news, like Facebook’s new Libra cryptocurrency, which will surely get the 2 billion people who use Facebook to learn more about other coins. Financial organizations such as JPMorgan are also looking at creating their own blockchains. This will further drive the adoption and awareness of cryptocurrencies.

The more interest in crypto trading heats up, the more it will be adopted. Widespread adoption is great news for everyone: miners, traders, and holders alike. Blockchain evolution will drive the crypto revolution, and it is coming fast.